Introduction

After a two-year stay, the Facebook-owned successful Instant messenger app WhatsApp eventually got the federal approval required to launch its transaction services in India on the Unified Payments Interface (UPI). WhatsApp Pay has been locked in beta mode for even more than two years and has been limited with just one million active users. However, the communication app has been permitted to launch UPI in specific examples and has been extended to 20 million users.

Mark Zuckerberg’s statements

source: technologyseeker.com

In a video statement, Facebook CEO Mark Zuckerberg said India has managed to open up many opportunities for micro and small enterprises by establishing the UPI, a transaction existing infrastructure by an alliance of giant banks across the country. India is the very first nation to do something like that. I’m glad we were able to support this initiative and work cohesively towards digitalized India. Zuckerberg also praised all those people that made WhatsApp Pay feasible in India.

When citizens have access to funds, they are more motivated to benefit themselves and others or start a company. In the long run, we need even more creativity that allows people power over their wealth, and purchase interest simply is a little movie that could help, “Zuckerberg continued.

Hours just after authorization, the organization also said Indians would submit money from Friday via WhatsApp. “Today, people throughout India will be able to transact via an app. This trusted transaction experience has made it easy to move money.

Whatsapp’s collaboration

source: benzinga.com

The day after permission has been given, they introduce the transaction feature in ten Indian regional languages. WhatsApp’s UPI entry starts with five banks – ICICI Bank, HDFC Bank, Axis Bank, State Bank of India, and Jio Payments Bank.

It’s Impact on other apps

WhatsApp Pay’s transaction entry is also a massive blow to two of its largest rivals – Google Pay and PhonePe, as NPCI has set a 30 percent cap for third party payment contractors. In the middle of all this, the receiver of WhatsApp Pay’s entry will be India’s wealthiest man’s e-commerce bet – JioMart’s Mukesh Ambani.

“Financial dealings remain a weak piece and tie up a possible showstopper with WhatsApp Pay convergence with JioMart. This feature’s UPI acceptance and future connection with JioMart after Facebook flooded $5.7 billion in Dependency sooner this year will see JioMart benefit by providing fast ordering and financial negotiation facilities to its customers.

As per the official NPCI release, UPI payments on third party transactions applications can not exceed 30% of the cumulative number of transactions performed in UPI over the previous three months. Both Google Pay and PhonePe, which are third-party applications, will be affected since they collectively carry alongside 40 percent of the UPI market share that has nearly reached the 2 billion count.

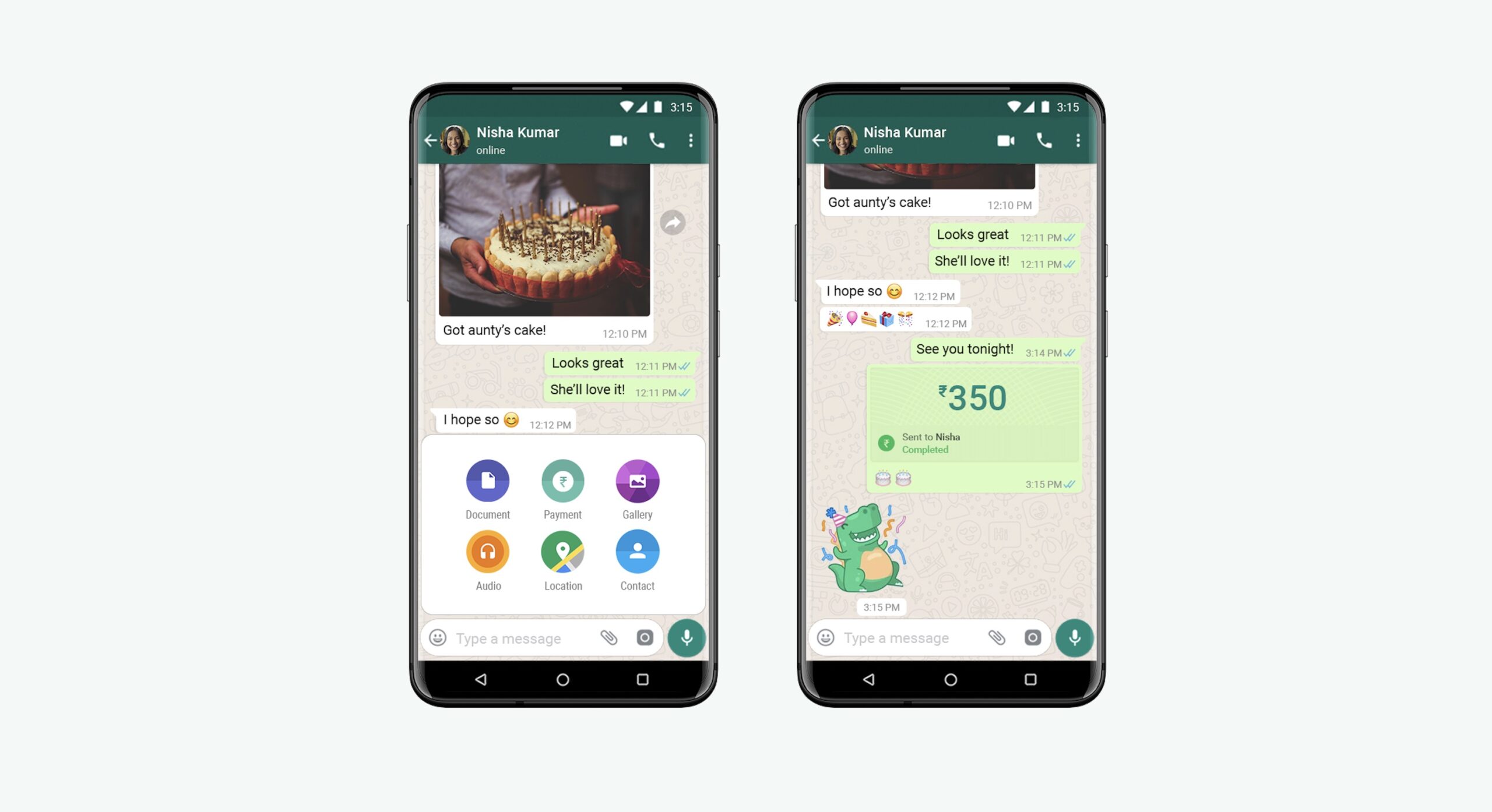

Whatsapp pay’s implementation

source: 90extra.com

India is the first country where Facebook started making transactions back in 2018 when WhatsApp started beta testing transactions. Since then, the company has faced a range of legal obstacles to data compilation, accompanied by a pledge to store user data to request updated data localization approval this year.

However, even though it had not formally been carried out, analysts have been predicting its success due to its current 400 million customer base in India. According to the June 2020 report, the prevalence of this new feature is projected to rise by 30 percent from the present 10 percent by 2025.

Abhijit Bose, Head of WhatsApp India, also announced the corporation’s economic resources foray ambitions in India in July 2020. This app will soon be pushing the economic development move into lending, micro-insurance, and micro-pension goods in India. They are currently running pilot projects for the same reason.