Second-home can also be a great real estate investment or for spending some couple of days on vacation. But, owning a second home in Seattle and Bellevue is an incredibly expensive investment. For that, one must require huge capital. Buying a second home in the current housing market is a great move. Mortgage rates are its lowest level. Low mortgage rates mean you can easily afford a home. Below we have mentioned some tips that help in getting a second home.

Saving up:

The main thing you have to do is have your finance lined up. The greatest impediment is the initial installment — the money you need to set aside and prepared to spend today. You can get a home loan credit for the remainder of the buy. Real estate investment is all about investing huge money on a fruitful land. So, if you wanted to buy a home without broke, first need you to need to save at least 12 months.

Get the help of Real Estate Agent:

The world of land financing can be confusing and complex. One thing to expect when you procure a real estate agent when purchasing a house is help with assessing and verifying the best financing for your conditions. A real estate agent can enable you to explore through the different financing alternatives and help you choose which kind of home loan is ideal. Notwithstanding helping you comprehend the different choices, a purchasers operator will probably enable you to verify financing through a home loan agent.

You will Need A Conventional Mortgage:

source: pymnts.com

You can purchase a second home as a venture property with a customary home loan. A preferred position of standard mortgages is that there aren’t numerous limitations on the kind of home you can purchase. Sorts of Properties Eligible for a Conventional Loan Single-family home Condo/townhouse 2-4 unit properties Conventional credits do require a higher initial installment than any Government upheld contract. You can also take the help of Bellevue mortgage company for financing best home loans.

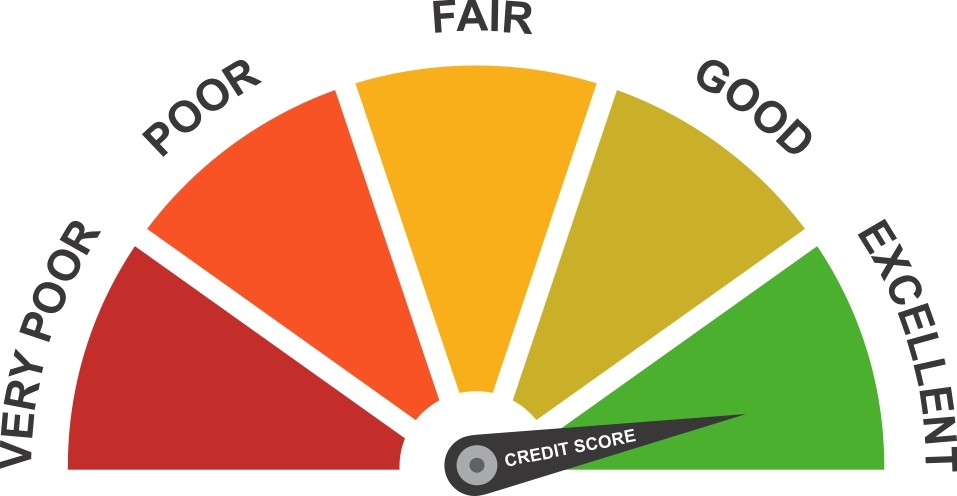

Credit-Score:

source: tigermobiles.com

Buying a home is not a small investment. And the first thing you need to check is the credit score. When it comes to qualifying for a home loan, your credit score is important to factor in your eligibility. If your credit score is poor then begin the increasing score process at least six months before buying home.

Analyze home price in Bellevue:

source: n-group.eu

Before entering into the real estate market, it is worth to analyze home price in Bellevue. It may give you a clear sense of how much you can afford. Once you analyze home price, in order to determine how much you can afford you can set the budget. This kind of research will give you a rough idea about your capability and save time and money. The medium home price was approaching $1 million in 2018. And the company has estimated that it would rise by 7.9% in 2019.

Get Pre-approved for Mortgage Loan:

source: rdcnewscdn.realtor.com

pre-approval describes that the lender is confident you have the ability to repay the amount and income can effectively cover your mortgage future payments. Along with that it also gives surety that you are the right buyer to purchase his property

Take help of mortgage lender:

A mortgage lender has the potential to approve your pre-approval loan and save your time and unnecessary expenses. He gathers your documents, apply for a pre-approval process, verify your credit history and gives a pre-approved letter in your hand

You may also like to know about What To Expect When You’re Selling Your House

To Conclude:

If you are looking to buy a second home in Bellevue, it is imperative to consider the above-mentioned tips while investing in real estate.